File Form 990-N (e-Postcard) Online

in Minutes

Simple, Safe & Secure E-filing

Enter your EIN to begin e-filing your

IRS 990-N form

IRS Mandates Electronic Filing of 990 Returns for Tax-Exempt Organizations.

Learn More

Tax990

Features

Innovative Features to Streamline Your

Form 990-N (e-Postcard) Online Filing

IRS-Authorized E-file Provider

We work closely with the IRS to offer a safe, secure and accurate e-file experience that saves you time

and effort.

Current & Prior Year Support

Our e-Postcard application supports both current and previous tax

year filings.

Check Return Status Instantly

Know the filing status of your e-Postcard immediately after transmitting to the IRS.

View Previous

Filing History

Check the filing history of your exempt organization and find out the status of the prior tax year forms.

Re-Transmit Forms

For Free

Our service identifies the issues for a rejected 990-N form so you can correct errors and re-transmit with no

extra cost.

User-Friendly Interface

Our easy-to-use, interview-style interface guides you step-by-step with e-filing your 990-N return quickly

and effortlessly.

US-Based Customer Support

Contact our 100% US-based support team of

e-file professionals located in Rock Hill, South California via phone, live chat or email regarding various questions and

assistance needs.

Safe & Secure Process

Our e-file application uses the most up-to-date security protections to ensure the safety of your

private information.

E-file For Unlimited Nonprofits From One Account

Tax preparers can transmit returns for an endless number of organizations from a single

account - add details for various exempt organizations with no extra charges or fees.

About Tax990

Tax990 is the leading e-file provider in the tax industry and makes it easier to

file form 990-N for small nonprofit organizations with the IRS.

Our web-based software remains updated with the latest tax filing rules and the most innovative technology. You can e-file your non-profit taxes confidently with ExpressTaxExempt while our technical team works hard to safeguard your information.

Other Forms Supported by ExpressTaxExempt

- Form 990

- Form 990-EZ

- Form 8868

Information Needed to File Form 990-N (e-Postcard) Online for

New Organizations

- Employer Identification

Number (EIN) - Organization's Tax Period

- Organization's Name & Address

- Any Other Names Used by the Organization

- Organization Website, if applicable

- Principal Officer Details

- Confirm Gross Receipts are

$50,000 or Less - A Statement That the Organization is Going Out of Business,

if applicable

Note: If your organization has already filed with the IRS, you won't need to enter the above information because our software will retrieve that data from the IRS database. The IRS only requires the information above if your organization is e-filing a IRS 990-N for the

first time.

Easy & Secure Steps to E-file Form 990-N (e-Postcard) with

Tax990

Quickly E-file Form 990-N (e-Postcard) for Current and Prior Tax Years

Search Your EIN

Enter your organization's Employer Identification Number to view your

filing history.

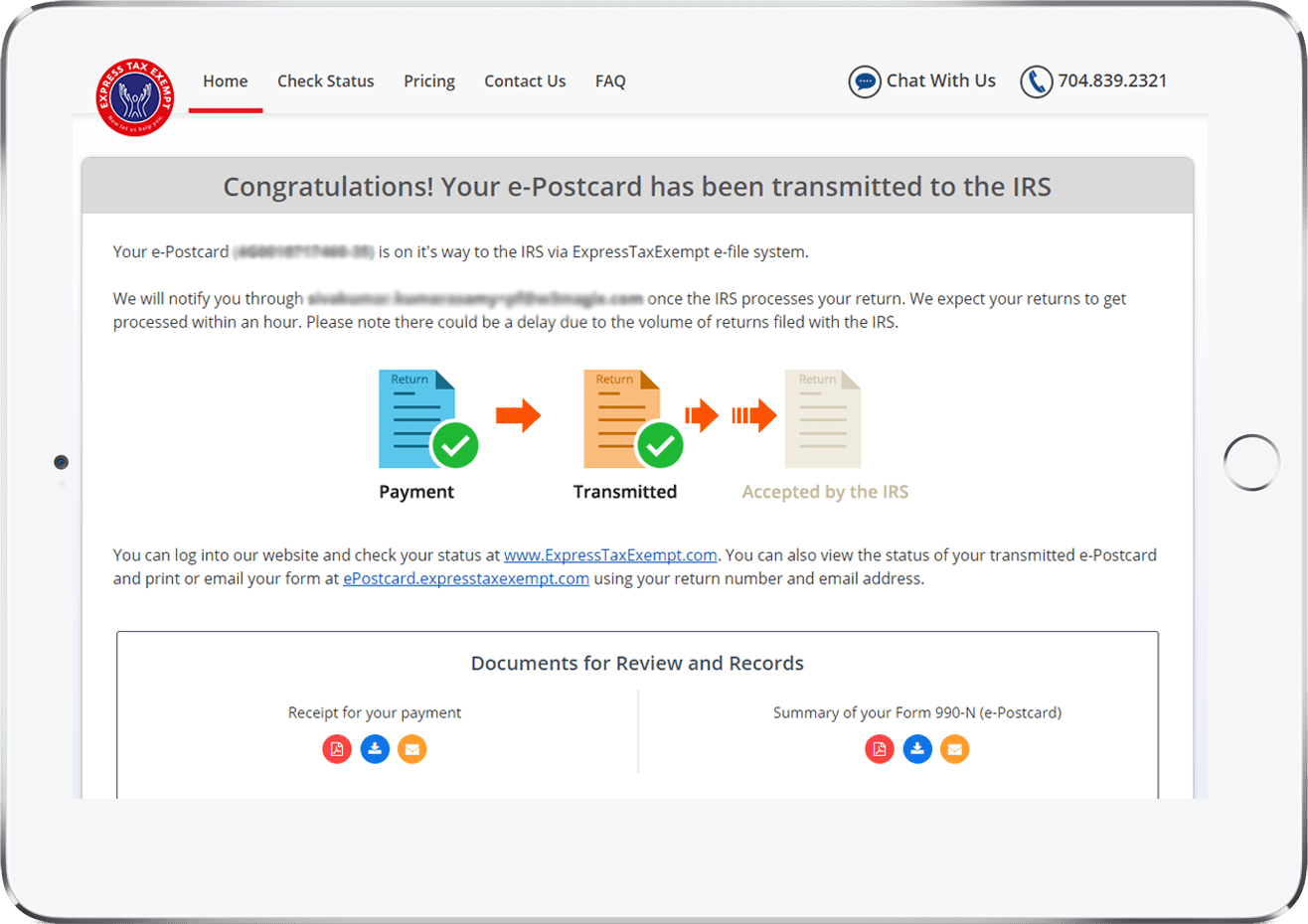

Choose Filing Year

Select the tax year you need to file and then create an account to review your organization details. You can even update your details

if necessary.

Review & Transmit to the IRS

Pay the processing fee and transmit to the IRS. Once sent, you can view your payment receipt and summary of the e-Postcard.